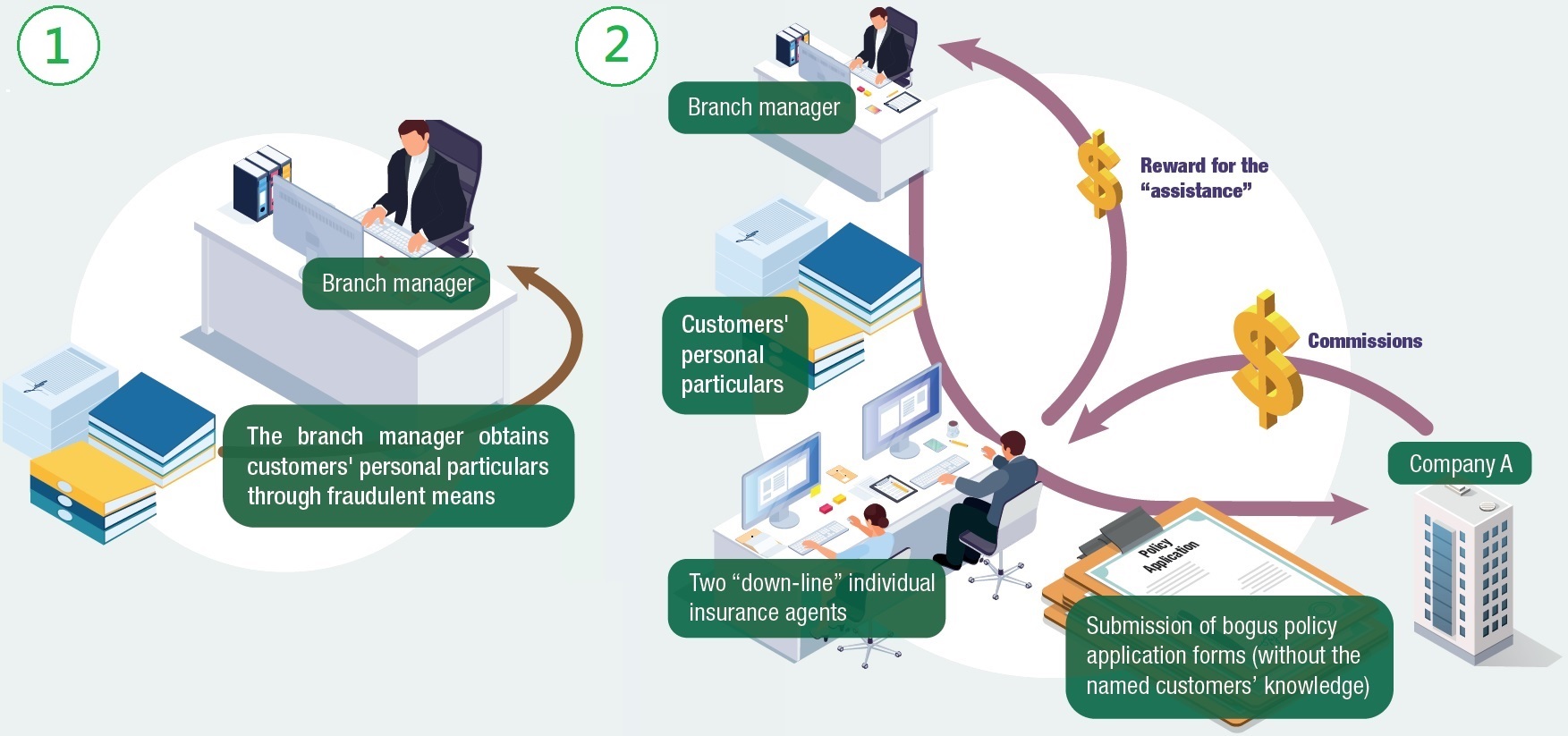

Sales Process - Submission of bogus policy applications to deceive commissions

-

A branch manager (who is also an individual insurance agent) of an insurance company (Company A) is required to reach the prescribed team sales targets and maintain certain number of productive “down-line” individual insurance agents. Two of his “down-line” individual insurance agents however fail to secure any sale of insurance policy. Knowing that Company A has not put in place any mechanism to deter/detect bogus policy applications, he proposes to the latter that he could source customers for them for submission of bogus policy applications. The “down-line” individual insurance agents concerned also agree to rebate him part of the commissions as reward for the “assistance”.

-

The branch manager then obtains personal particulars through fraudulent means (e.g. record of his and other customers of Company A) and provides such to the “down-line” individual insurance agents for the purpose of submitting bogus policy applications. The “down-line” individual insurance agents name themselves as the handling agent on the bogus policy applications and then conspire with the branch manager to submit the bogus policy application forms to Company A, without the named customers’ knowledge.

Offence Committed

-

The branch manager is an agent of Company A. He solicits advantages (i.e. sharing of the commissions earned by his two “down-line” individual insurance agents) from his “down-line” individual insurance agents for providing “assistance” in submitting bogus policy applications to Company A (i.e. his principal) which is related to the affairs of Company A. Without the permission of Company A to solicit such advantages, he contravenes Section 9(1) of the Prevention of Bribery Ordinance (Cap. 201) (POBO). The two “down-line” individual insurance agents also contravene Section 9(2) of the POBO by offering the advantages under such circumstances.

-

The two “down-line” individual insurance agents are also agents of Company A. They conspire with the branch manager (an agent of Company A) to use bogus policy application forms to deceive Company A (i.e. their principal) for ineligible commissions. Both the two “down-line” individual insurance agents and the branch manager contravene Section 9(3) of the POBO as they use bogus policy application forms in respect of which their principal is interested and with an intent to deceive their principal.

Case in Perspective

Some corrupt insurance intermediaries might submit bogus policy applications to deceive insurance companies for soliciting the extra/ineligible commissions earned from the parties involved, meeting individual/team sales targets and earning extra allowances, etc. Apart from contravention of the POBO by the insurance intermediaries concerned, such malpractice will adversely affect the insurance companies’ profitability as those bogus policies usually lapse after a short period of time. Moreover, the bogus policy application scam often involves a syndicate of the “up-line” and “down-line” individual insurance agents and hence creates a negative impact on the integrity culture of the companies. If there are inadequate controls in the insurance company, this would create opportunities and temptation for exploitation by the corrupt parties concerned. In order to deter/detect the related malpractice in the above case, insurance companies are advised to pay attention to red flags (i.e. indicators of areas where management oversight is required to safeguard against possible corruption) and put in place adequate corruption prevention safeguards. Examples of red flags and safeguards include –

Red Flags

-

Abnormal patterns in insurance intermediaries’ portfolios such as –

-

high level of policy lapse rate; and

-

small amount of policies but with high sum insured.

-

Unexpected increases in sales transactions by insurance intermediaries that are exceptional or without apparent reasons in a short period of time.

-

Abnormal premium paying pattern such as –

-

premiums of policies being paid by third parties who have no apparent connection with the insured or policy holders; and

-

insurance intermediaries’ portfolios having a relatively high number of insurance policies with premium payments in arrears.

-

Submission of suspicious supporting documents for policy applications via insurance intermediaries.

Safeguards

-

Draw customers’ attention to important notes such as the need for them to contact the insurance company directly (e.g. by providing them an enquiry hotline) if they receive suspicious insurance policies.

-

Set reasonable sales targets for insurance intermediaries in a way that the company’s commission policy does not provide incentives or opportunities for engagement in corrupt or fraudulent activities (e.g. avoiding overly high commission in the initial years of the policy term), and review the sales targets and commission policy periodically to verify that there are reasonable safeguards in place to prevent them from encouraging bribery.

-

Put in place a mechanism to deter corruption/fraud cases in the design of the insurance intermediary agreements (e.g. including adequate clawback provisions to fully recover all commissions paid in case of committing corrupt or other malpractice).

-

Include persistency ratio as one of the considerations/factors for promoting individual insurance agents to reduce incentive for submission of bogus policy applications.

-

Require customers to fill in their mobile numbers on the policy application documents and conduct cross-checking with the handling individual insurance agents’ mobile numbers to lessen the risk of individual insurance agents using their own mobile numbers for submission of bogus policy applications.

-

As far as practicable, send insurance policies directly to the policy holders rather than through the insurance intermediaries so as to deter fabrication of policy applications by using customer details without the latter’s knowledge.

-

Generate and analyse management reports (e.g. report on the policy lapse rate of individual insurance intermediaries) and exception reports (e.g. exceptional increase in sales transaction by a particular insurance intermediary within a short period of time), and investigate anomalies detected.