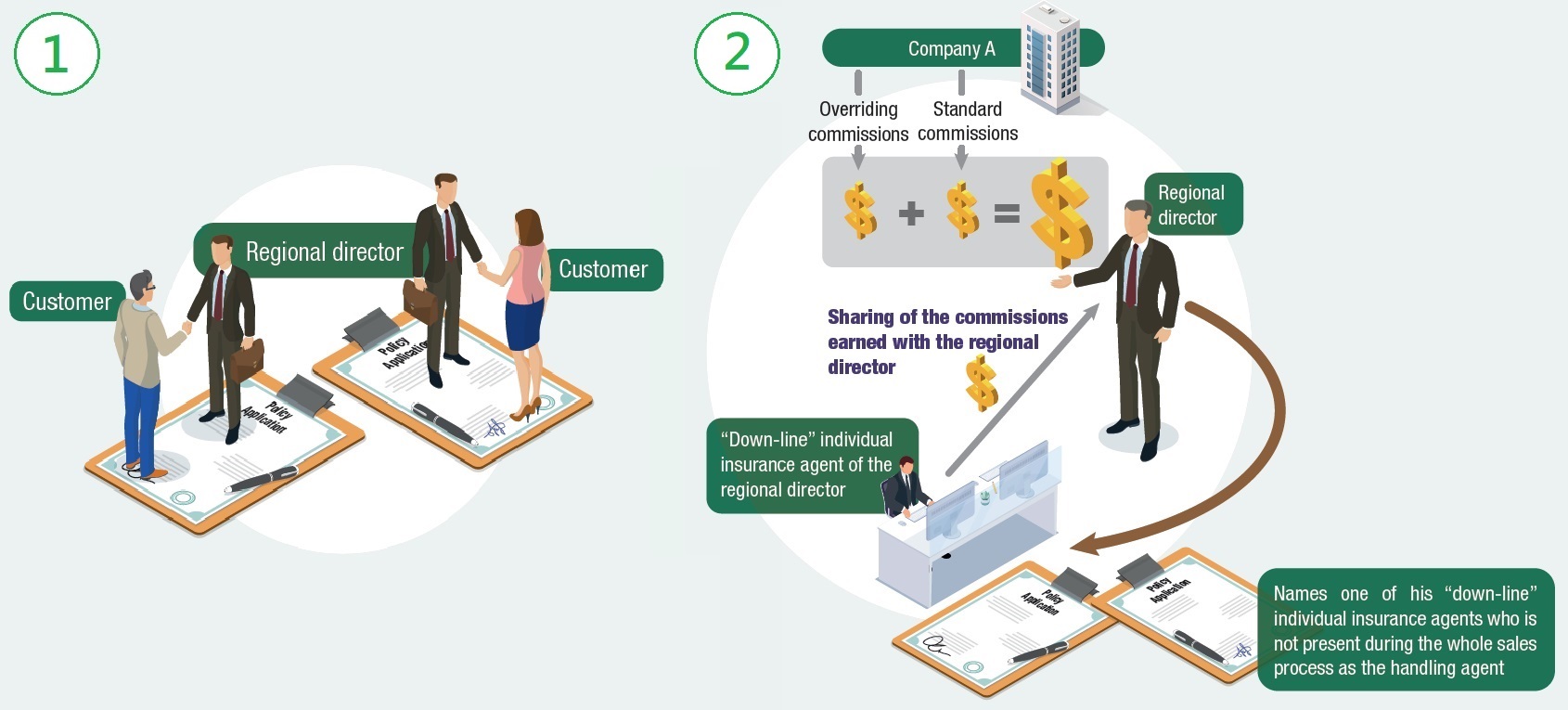

Sales Process - False representation of the handling agent on the policy application forms to deceive more commissions

-

A regional director (who is also an individual insurance agent) of an insurance company (Company A) can earn overriding commissions upon sale of insurance policies by his “down-line” individual insurance agents, in addition to the standard commissions issued to the latter.

-

The regional director meets and explains an insurance product to two customers himself who agree to buy the insurance product. Upon his request, the two customers respectively sign on their policy application forms for confirming applications of the insurance product, without being aware of the need to check the name of the handling agent.

-

Afterwards, the regional director names one of his “down-line” individual insurance agents who is not present during the whole sales process as the handling agent on the policy application forms so that he can also earn the overriding commissions, in addition to the commissions earned by his “down-line” individual insurance agent (i.e. the total commissions earned is more than the commissions he could earn by naming himself as the handling agent). He also solicits advantages from the latter by requesting sharing of the commissions earned by the latter. The “down-line” individual insurance agent agrees to such arrangement as he could also meet his sales target.

-

The regional director then conspires with the “down-line” individual insurance agent to submit the policy application forms containing false information to Company A. Company A also does not have adequate safeguards (e.g. random post-sales confirmation calls to verify some essential information of the sales process, inclusion of adequate clawback provisions to recover commissions paid in case of conduct of malpractice) to deter/detect related malpractice and releases the commissions to the syndicate. The “down-line” individual insurance agent then gives majority of the commissions he earned to the regional director.

Offence Committed

-

The regional director is an agent of Company A. He solicits advantages (i.e. sharing of the commissions earned by the “down-line” individual insurance agent) from the “down-line” individual insurance agent for submitting policy application documents containing false information to Company A (i.e. his principal) which is related to the affairs of Company A. Without the permission of Company A to solicit such advantages, he contravenes Section 9(1) of the Prevention of Bribery Ordinance (Cap. 201) (POBO). The “down-line” individual insurance agent also contravenes Section 9(2) of the POBO by offering the advantages under such circumstances.

-

The “down-line” individual insurance agent is also an agent of Company A. He conspires with the regional director (an agent of Company A) to use policy application documents with false information to deceive Company A (i.e. their principal) for more commissions. Both the “down-line” individual insurance agent and the regional director contravene Section 9(3) of the POBO as they use policy application documents with false information in respect of which their principal is interested and with an intent to deceive their principal.

Case in Perspective

Some dishonest insurance intermediaries might falsely represent on the policy application documents that other insurance intermediaries who are not involved in any part of the sales process as the handling agents of the applications with a view to soliciting the commissions earned by the latter. Apart from contravention of the POBO by the insurance intermediaries concerned and causing financial loss to insurance companies, such improper practice among insurance intermediaries will also put the companies’ reputation at stake, thereby affecting the customers’ confidence in the companies. If there are inadequate controls in the insurance company, this would create opportunities and temptation for exploitation by the corrupt parties concerned. In order to deter/detect the related malpractice in the above case, insurance companies are advised to pay attention to red flags (i.e. indicators of areas where management oversight is required to safeguard against possible corruption) and put in place adequate corruption prevention safeguards. Examples of red flags and safeguards include –

Red Flags

-

Unexpected increases in sales transactions by insurance intermediaries that are exceptional or without apparent reasons in a short period of time.

Safeguards

-

Include a warning in relevant documents (e.g. insurance intermediary declaration form which is attached to the policy application form) to warn insurance intermediaries against submission of false information (e.g. falsely representing on the policy application documents that another insurance intermediary who is not involved in the sales process is the handling agent of the applications) and the possible consequences (e.g. incurring criminal liabilities), and require them to declare on relevant documents that all the information and supporting documents provided to the insurance company are true and accurate.

-

Draw customers’ attention to important notes such as the need for them to check policy terms and other essential information (including, amongst others, the name of the handling agent) carefully and avoid signing blank or unclear documents.

-

Prohibit individual insurance agents from requesting or advising customers to sign on blank/incomplete policy application documents.

-

Provide electronic means of application (e.g. via e-application App) for the insurance intermediaries’ submission of policy applications during the sales meeting with the customers / potential policy holders to lessen the risk of false representation of handling agents as the names of the handling agents are electronically logged on the electronic policy application documents.

-

Stipulate the names of the policy handling agents in the insurance policies and send direct messages (e.g. SMS alerts) to the policy holders concerned to inform them of the names of the policy handling agents, status of their policy applications and the company enquiry telephone number.

-

Make post-sales confirmation calls to customers on a risk basis to verify some essential information of the sales process (e.g. the names of the handling agents), and take appropriate follow-up action(s) for suspicious case(s).

-

Conduct random supervisory checks (e.g. by respective Distribution Channel Departments) and independent checks (e.g. by the Compliance Department, Internal Audit Department) on new business and/or high risk applications (e.g. policy applications submitted via individual insurance agents with previous disciplinary record / abnormal portfolio) to deter and detect malpractice; and make the parties concerned (e.g. individual insurance agents) aware of the random/independent check policy for deterrence purpose.