Use of Bogus Invoices

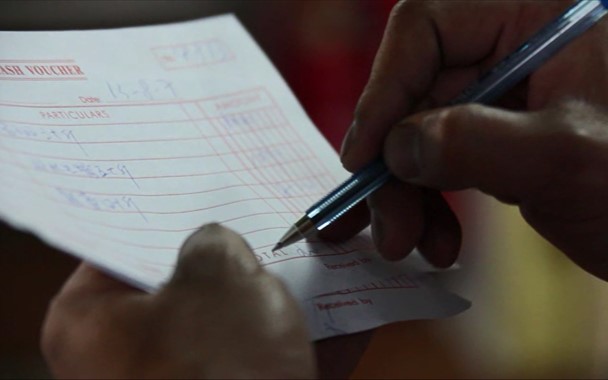

A manager of a trading company was solely responsible for placing shipping orders and checking invoices submitted by freight forwarders or transportation companies. He was authorised to issue orders not exceeding a specified amount while orders with value over the specified amount required approval by his superior. Over a few years, the manager split the orders into small ones so that he could authorise the issue of orders. He also used a number of false invoices of a dormant transportation company he had set up to deceive payment from the trading company. The bogus invoices, amounting to several million dollars, purportedly showed that the company owned by the manager had provided transportation services to the trading company.Offences Committed

The manager, an employee (i.e. agent) of the trading company (i.e. principal), used bogus invoices to deceive freight charges from the trading company. The manager had contravened Section 9(3) of the POBO as he used bogus invoices in respect of which his principal was interested and with an intent to deceive his principal.

Case in Perspective

The manager had seriously breached the trust placed by the employer. To prevent such malpractice, the company should adopt adequate safeguards. For example,

(a) have proper segregation of duties (e.g. preparation of orders, approval of orders and checking of invoices performed by different staff members).

(b) generate regular management reports to facilitate review and identification of abnormalities by management.

(c) pay attention to any warning signs of possible malpractices (e.g. a number of similar orders or invoices for providing similar services/goods with values just slightly below an approval limit within a short period of time).