Case Studies

Sales Process - False representation of the handling agent on the policy application forms to deceive more commissions

Sales Process - False representation of the handling agent on the policy application forms to deceive more commissions

-

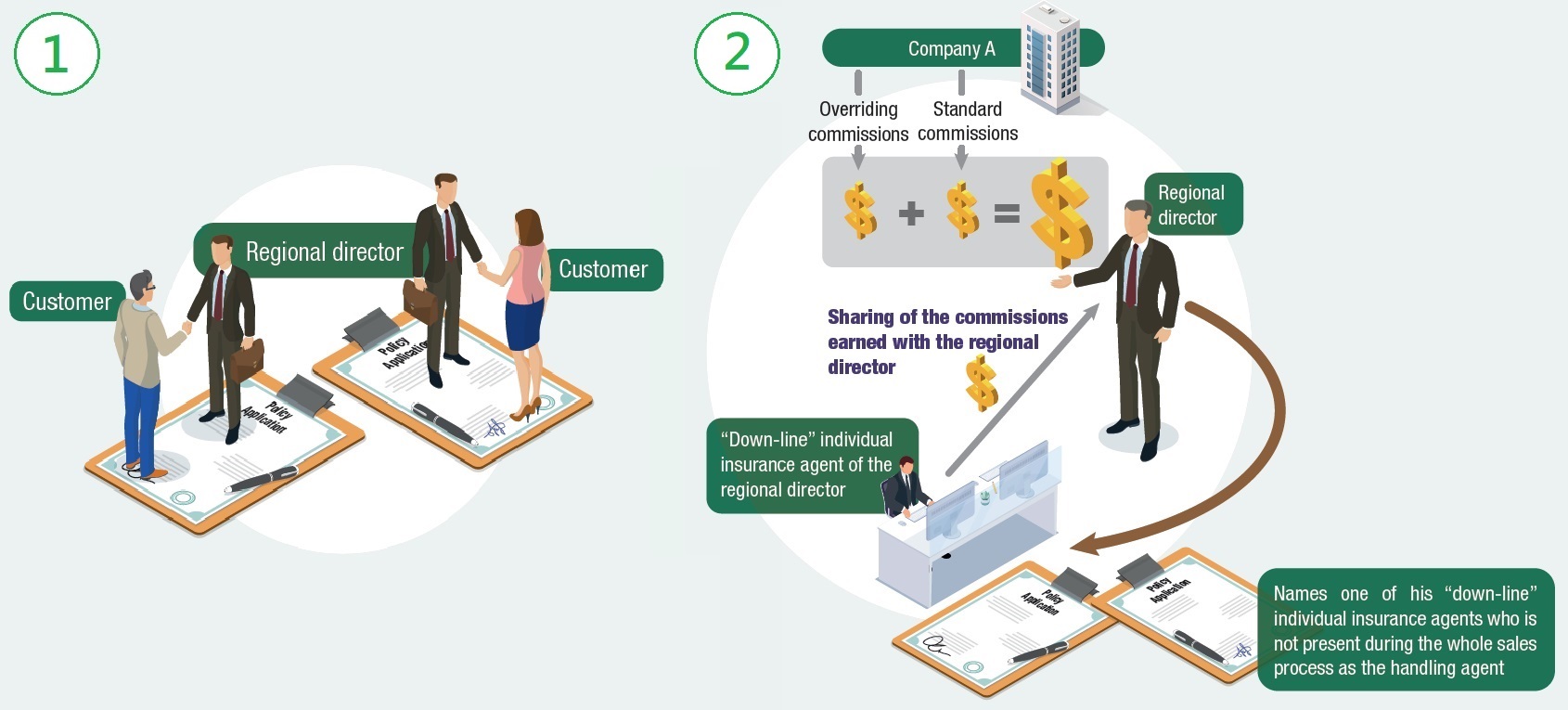

A regional director (who is also an individual insurance agent) of an insurance company (Company A) can earn overriding commissions upon sale of insurance policies by his “down-line” individual insurance agents, in addition to the standard commissions issued to the latter.

-

The regional director meets and explains an insurance product to two customers himself who agree to buy the insurance product. Upon his request, the two customers respectively sign on their policy application forms for confirming applications of the insurance product, without being aware of the need to check the name of the handling agent.

-

Afterwards, the regional director names one of his “down-line” individual insurance agents who is not present during the whole sales process as the handling agent on the policy application forms so that he can also earn the overriding commissions, in addition to the commissions earned by his “down-line” individual insurance agent (i.e. the total commissions earned is more than the commissions he could earn by naming himself as the handling agent). He also solicits advantages from the latter by requesting sharing of the commissions earned by the latter. The “down-line” individual insurance agent agrees to such arrangement as he could also meet his sales target.

-

The regional director then conspires with the “down-line” individual insurance agent to submit the policy application forms containing false information to Company A. Company A also does not have adequate safeguards (e.g. random post-sales confirmation calls to verify some essential information of the sales process, inclusion of adequate clawback provisions to recover commissions paid in case of conduct of malpractice) to deter/detect related malpractice and releases the commissions to the syndicate. The “down-line” individual insurance agent then gives majority of the commissions he earned to the regional director.

See More

Sales Process - Submission of bogus policy applications to deceive commissions

Sales Process - Submission of bogus policy applications to deceive commissions

-

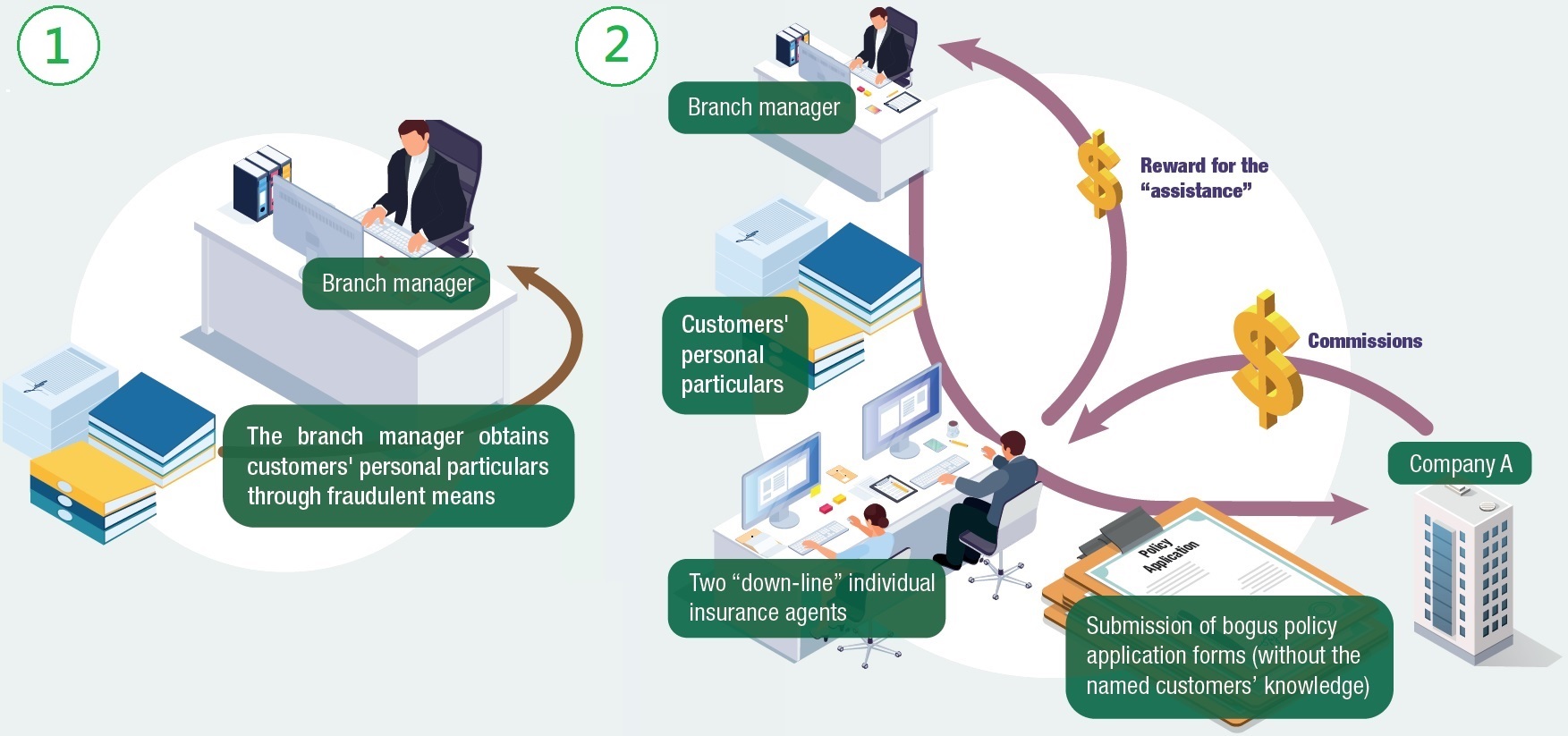

A branch manager (who is also an individual insurance agent) of an insurance company (Company A) is required to reach the prescribed team sales targets and maintain certain number of productive “down-line” individual insurance agents. Two of his “down-line” individual insurance agents however fail to secure any sale of insurance policy. Knowing that Company A has not put in place any mechanism to deter/detect bogus policy applications, he proposes to the latter that he could source customers for them for submission of bogus policy applications. The “down-line” individual insurance agents concerned also agree to rebate him part of the commissions as reward for the “assistance”.

-

The branch manager then obtains personal particulars through fraudulent means (e.g. record of his and other customers of Company A) and provides such to the “down-line” individual insurance agents for the purpose of submitting bogus policy applications. The “down-line” individual insurance agents name themselves as the handling agent on the bogus policy applications and then conspire with the branch manager to submit the bogus policy application forms to Company A, without the named customers’ knowledge.

See More

Claims Verification - Individual insurance agents colluding with policy holders and other parties to file false claims

Claims Verification - Individual insurance agents colluding with policy holders and other parties to file false claims

-

An individual insurance agent “recruits” a number of persons and successfully applies for them accident insurance policies from a number of insurance companies, including his own appointing insurance company. He also secures the agreement of the persons to inflict self bodily injuries for the purpose of making false claims under the insurance policies concerned.

-

Noting that the insurance companies concerned have yet to have a mechanism of cross-checking claims with other insurance companies for identification of suspicious claims, the individual insurance agent conspires with a medical practitioner and a Chinese medicine practitioner for their issue of multiple “original” medical certificates to each alleged patient with exaggerated injuries.

-

As a result, the insurance companies concerned are deceived to pay out the compensation.